CRES International

Cres International has been established as a trading, import/export company in Egypt

Our Purpose

To be a leader in each business segment by providing enhanced services, relationship and profitability. offering wide variety of brands and products in both local and international markets covering the basic day to day product range as well as new innovative solutions that are

catered to consumers’ needs.

Since its inception in 2005 Cres International has been developing partnerships/joint ventures in multiple

segments and industries and has thus acquired an extensive network and expertise in diversified fields.Having based ourselves on the features demanded by large companies, a commitment to achieving the

highest standards of quality and performance, together with a logistic capability that has few equals, all

have combined to build Cres International reputation as a major player that answers the needs of today’s clients in various business fields.

Vision

To become the top globally impacting trading company enriching lives with quality and innovative products.To provide quality products that exceeds the expectations of our esteemed customers.

Mission statement

Is to improve consumers’ lifestyles by unlocking the potential of brands

awareness and delivering the best quality of products from source to han

Core Values

We believe in treating our customers with respect and faith. We grow through creativity, invention and innovation. We integrate honesty, integrity and business ethics into all aspects of our business functioning.

Goals

To build long term relationships with our customers and clients by providing

exceptional brands and pursuing business through innovation and client’s needs.

Egypt: Land of the Pharaohs

EGYPT In a Glimpse

Egypt is now at a turning point. Oil and gas exports, Suez Canal and tourism receipts as well as remittances sent by expatriate workers, which financed half of imports in 2015 is positioning Egypt as one of the biggest trading hubs in the Middle East.

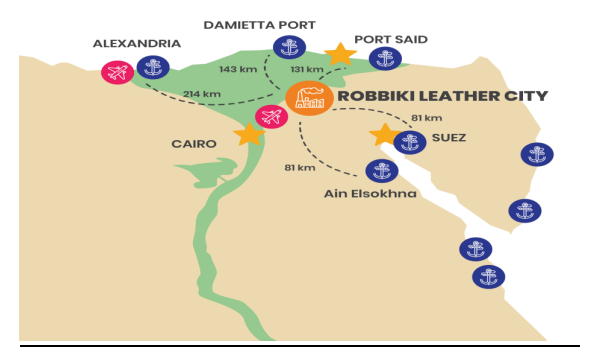

The geographical pattern is more diversified on the import side. Nearly 40 per cent of imports from NAFTA countries are agricultural products (partly tied to the US aid) while processed food comes mainly from the Rest of the World (ROW). The EU and the ROW are competing in Egypt for most products, in particular for equipment goods, which represent one-third of total imports. Blessed with a long coastline, Egypt has nine ports, of which the busiest are Alexandria, Port Said, and Suez.

Alexandria, which has a fine natural harbor, handles most of the country’s imports and exports, as well as the bulk of its passenger traffic. Port Said, at the northern entrance to the Suez Canal, lacks the berthing and loading facilities of Alexandria. Suez’s main function is that of an entry port for petroleum and minerals from the Egyptian Red Sea coast and for goods from Asia.

Fact Sheet

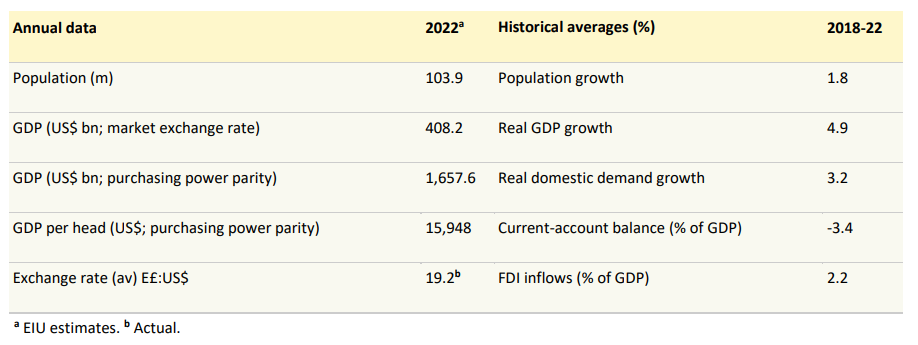

GDP in Egypt is expected to reach 420.31 USD Billion by the end of 2023, according to Trading Economics global

macro models and analyst’s expectations. In the long-term, the Egypt GDP is projected to trend around 439.22

USD Billion in 2024 and 461.18 USD Billion in 2025.

Egypt is a signatory to several multilateral trade agreements:

• The African Continental Free Trade Area (AFCFTA)

• The General Agreement on Tariffs and Trade (GATT)

• The General Agreement on Trade in Services (GATS)

• European Union-Egypt Free Trade Agreement (Association Agreement)

• Free Trade Agreement with EFTA States

• Turkey-Egypt Free Trade Agreement

• Greater Arab Free Trade Area Agreement

• Agadir Free Trade Agreement among Egypt, Morocco, Tunisia and Jordan

• Egyptian-European Mediterranean Partnership Agreement

• The Common Market for Eastern and Southern Africa (COMESA)

• Pan Arab Free Trade Area (PAFTA)

• Egypt-MERCOSUR Free Trade Agreement

Why is Egypt a good place to trade?

Egypt is located at the crossroads of three continents and also boasts an excellent geographical location,close to major strategic routes such as the Suez Canal. For European countries, this African country also has the advantage of being accessible in a few hours by air from major European cities.

How many retailers are there in Egypt?

Modern retail channels, such as supermarkets, hypermarkets and convenience stores, have a combined 3,913 outlets and represent around 26 percent of total sales. Traditional grocery retailers have 113,724 and represent 74 percent of total sales.

How big is the retail market in Egypt?

As of 2020 the country’s retail market was worth approximately $200bn, and forecast to grow at compound annual growth rate (CAGR) of around 5% in 2020-25 to reach $254bn.

How much money does tourism bring to Egypt?

Egypt’s Tourism Revenue reached 4 USD bn in Sep 2022, compared with 3 USD bn in the previous quarter.

How big is the food retail market in Egypt?

The Egyptian food & grocery retail market had total revenues of $60.1bn in 2020, representing a compound annual growth rate (CAGR) of 14.3% between 2016 and 2020. The food segment was the market’s most lucrative in 2020, with total revenues of $52.1bn, equivalent to 86.7% of the market’s overall value.

What is the total market for confectionery?

Revenue in the Confectionery segment amounts to US$1.11tn in 2023. The market is expected to grow annually by 4.77% (CAGR 2023-2027).

Our Latest Partners

Our Clients

Phone

Address

33 El-Nahda Street – Maadi – Cairo – Egypt